Nigeria Banks Expand Across Africa as Global Lenders Retreat

By GLEBM NEWS DESK

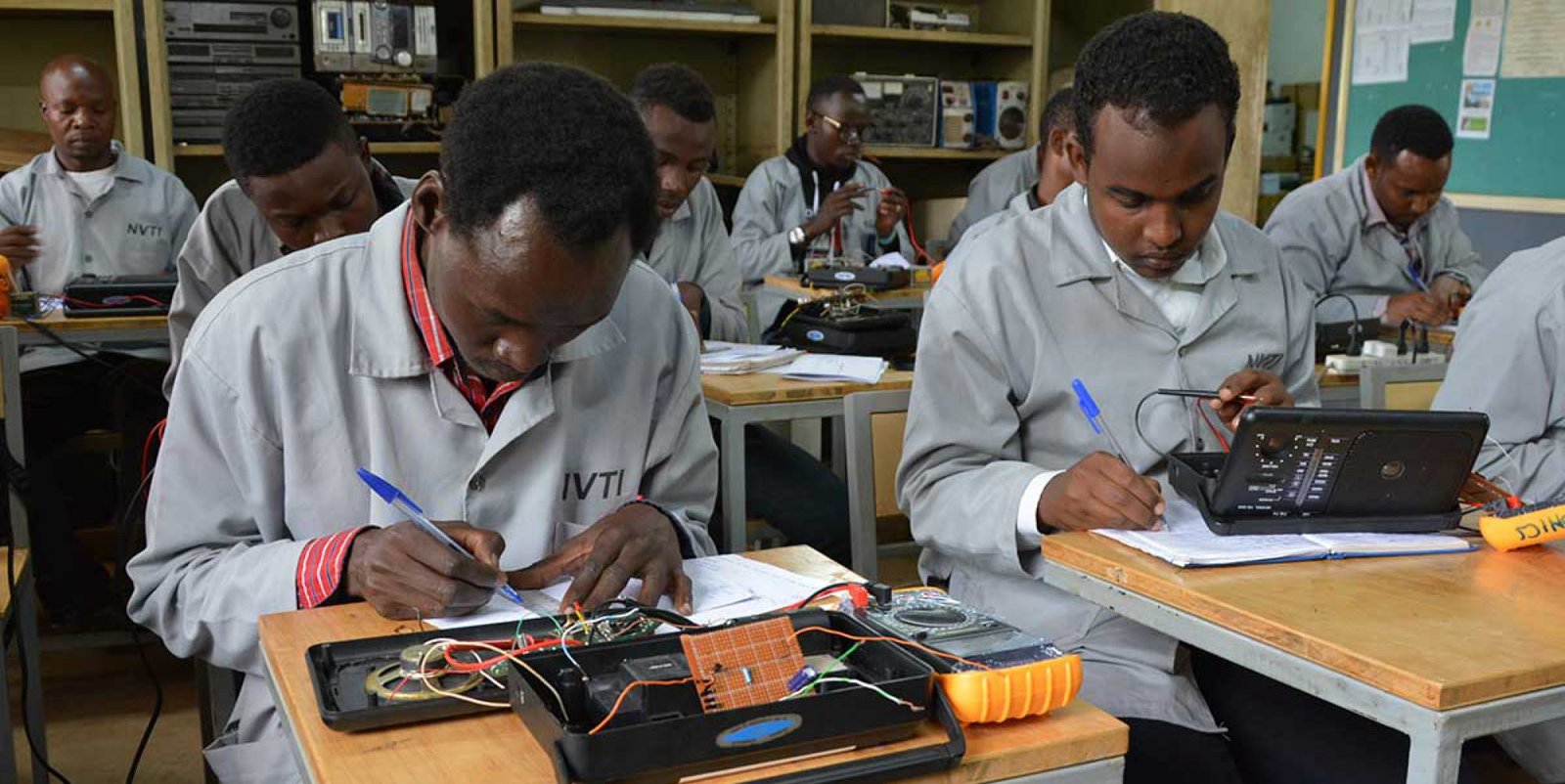

As some international banks pull back from African markets, Nigeria’s largest financial institutions are accelerating their expansion across the continent, according to industry reports.

With higher capital buffers following recent recapitalisation efforts, Nigeria’s major lenders are using their strengthened balance sheets to diversify earnings and spread risk beyond domestic borders. Analysts say this strategy responds both to profit pressures at home and to opportunities created by the retreat of some global lenders.

Growing Continental Presence

Banks such as Access Bank, United Bank for Africa (UBA) and others have historically established footprints beyond Nigeria. Access Bank, for example, operates in several African countries and has continued to pursue expansion strategies targeting markets in East and Southern Africa.

Financial observers say the retreat of some foreign banks from the continent has created space for local institutions to expand. Nigerian banks are leveraging larger capital bases gained from the Central Bank of Nigeria’s recapitalisation policies, enabling them to enter new markets and offer a broader range of financial services.

The expansion trend comes amid positive signs for the Nigerian economy more broadly. Recent business activity data suggests Nigeria may experience faster growth in 2026, supported in part by stronger services and manufacturing sectors, which in turn can support robust banking performance.

Regional Leadership and Competitive Shift

Industry insiders note that Nigerian banks are increasingly seen as regional leaders in financial services, helping to reshape the landscape of African banking in a period of strategic retreat and realignment by some global financial institutions.